Financial Behavior and Psychological Influence

Psychology/Humans-Finance

Psychology of Money — Humans

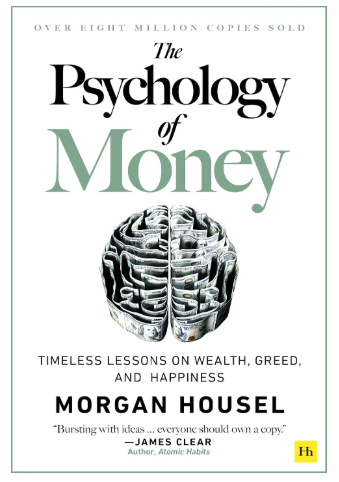

If you want to understand why money decisions feel hard, start here.

Money behavior is driven more by emotion, experience, and environment than math. This book explains how people actually think about risk, wealth, and security — without formulas or hype — so decisions make more sense in real life.

Understanding Money Mindset

“Explore the psychology of money and learn to transform your financial habits for a healthier relationship with finances.”

Financial Behavior & Stability

“Explore the psychology behind money decisions so you can replace reactive habits with stable financial structure.”

$8.72)- Thinking, Fast and Slow – Daniel Kahneman’s classic that’ll change how you see decision-making. Learn how your mind works so you can think smarter about money and life.

$20.57)- Me, But Better – A practical, uplifting guide to becoming your best self—without the pressure. Small changes, real growth, smarter living.

$9.59)- Seven and a Half Lessons About the Brain – Quick, fascinating lessons on how your brain shapes everything you do. Short listen, big insights.

$16.68)- Being You: A New Science of Consciousness – Anil Seth dives deep into what it really means to “be you.” Eye-opening, thought-shifting, and perfect for expanding your mindset.

$00.99)- The New Emotional Intelligence – Learn how mastering your emotions can boost your decision-making, relationships, and long-term success.

$11.26)- The Power of Habit – Discover why we do what we do and how to build better habits that stick—for your wallet, your work, and your life.

Affiliate Disclaimer: “As an Amazon Associate, Mr. Why may earn from qualifying purchases. Your support helps keep our financial lessons free—at no extra cost to you.”

🧠The Psychology of Money & Financial Stability

Explore how behavioral biases shape financial decisions and how disciplined structure protects long-term financial control. 🧠

Money Psychology

How Emotions Influence Financial Decisions

Financial decisions are rarely logical. Behavioral finance research shows that emotions often override strategy — leading to instability when not managed properly.

Here are the most common psychological patterns that impact financial stability:

1. Fear & Anxiety

Fear during uncertainty can trigger impulsive actions — selling at losses, avoiding necessary decisions, or freezing entirely. Stability requires predefined goals and structured plans that prevent reactive behavior.

2. Overconfidence

Excess confidence can lead to overlooked risks and poor judgment. Discipline, review systems, and second checks reduce costly errors.

3. Loss Aversion

People feel losses more intensely than gains. This often causes avoidance of necessary action or excessive conservatism that limits progress. Structured evaluation helps separate real risk from emotional discomfort.

4. Herd Mentality

Following trends without independent evaluation increases risk. Financial stability requires research, verification, and disciplined decision frameworks.

5. Emotional Spending Under Stress

Stress can drive unnecessary spending or avoidance of responsibilities. Systems like budgeting, tracking, and scheduled reviews reduce emotional interference.

6. Avoidance Behavior

Ignoring bills or financial obligations increases long-term damage. Predictable payment systems and structured cash flow management protect stability.

Core Principle

Emotions are unavoidable — instability is not.

When awareness is combined with structured financial systems, decisions become deliberate rather than reactive.

Stability becomes consistent — and growth becomes sustainable.

How Cognitive Biases Shape Financial Decisions

Cognitive biases are mental shortcuts that influence decisions — often without conscious awareness. Even when we believe we are acting rationally, these patterns can distort financial judgment and create instability.

The most common biases affecting financial behavior include:

1. Confirmation Bias

Seeking information that supports existing beliefs while ignoring opposing evidence. This can prevent necessary financial adjustments and reinforce poor habits. Structured review systems help ensure balanced evaluation.

2. Anchoring Bias

Fixating on initial numbers (income, budgets, prices) and failing to adjust when circumstances change. Regular financial reassessment prevents outdated assumptions from guiding decisions.

3. Overconfidence Bias

Overestimating knowledge or skill can lead to excessive risk-taking and under-diversification. Discipline and independent verification reduce exposure to avoidable losses.

4. Loss Aversion

The pain of losing money is stronger than the pleasure of gaining it. This often results in hesitation, avoidance, or holding onto poor decisions too long. Clear risk frameworks separate emotional discomfort from rational evaluation.

5. Herd Mentality

Following trends without independent analysis increases volatility and risk. Stability requires personal evaluation and structured decision criteria.

6. Endowment Effect

Overvaluing what we already own simply because it is ours. Letting go of outdated assets or habits is often necessary for progress.

7. Neglect of Probability

Overreacting to dramatic but unlikely outcomes while ignoring realistic probabilities. Sound financial decisions rely on measured risk assessment — not emotional narratives.

Managing Cognitive Bias

Bias cannot be eliminated — but it can be managed through structure:

Establish clear evaluation criteria.

Use systematic decision processes.

Review financial decisions regularly.

Balance automation with informed human oversight.

When awareness is paired with disciplined systems, financial decisions become consistent, stable, and sustainable.

Stability reduces emotional interference — and growth becomes intentional rather than reactive.

Healthy Mindset

“Strengthen financial stability by building disciplined habits and structured decision-making.”

Debt Awareness

“Recognize how unmanaged debt destabilizes cash flow and limits financial options.”

"The Truality Cause', the brand that is dedicated to integrity, transparency, and delivering accurate, trustworthy content to empower our users."

© 2025. All rights reserved.

"Dedicated to Helping You Build Your Financial Future". Please, feel free to subscribe to our newsletters, updates, and special offers!

2025> please be informed site was AI assisted ⚠️ Content Integrity Protected

🔒 User-Secured Validation

🔒 AI-Assisted Content Notice > Portions of this website's content have been generated or enhanced using artificial intelligence tools. While efforts are made to ensure accuracy and reliability, AI-generated content may contain errors or inaccuracies. Users are encouraged to verify information and consult professionals for advice. [TRUALITY] is committed to transparency and content integrity. Please report to us any concerns.

© 2026 MrWhy Consulting - SaaS

"An Expert In Psychology, Law & Finance!"

“My work is descriptive and analytical — focused on understanding patterns, not prescribing universal solutions.”

The Anti-Shark

“I’m here to Make you money, not take it.”

“I’m here to help, not exploit.”

"Remember to Stay Steady, Stay Real, and Stay You!"